-

play_arrow

play_arrow

Fresh 106 Fresh 106

-

play_arrow

play_arrow

London Calling Podcast Yana Bolder

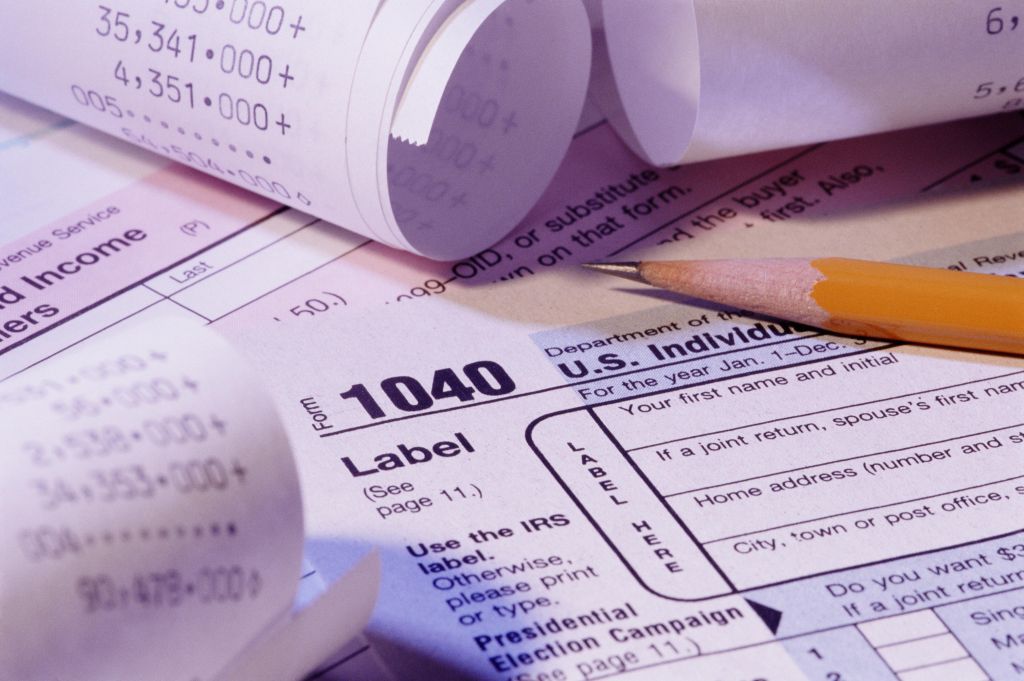

Big Profits: Predatory Tax Prep Companies And Their Reliance On Black Customers

Tax season should be a chance for Americans to collect what they’re owed—not a payday for billion-dollar corporations. Yet, every year, tax prep giants rake in billions by charging fees for a service that should be free to every taxpayer.

For millions of people, tax season is both something to anticipate and something to dread- an annual ritual of gathering W-2s, navigating confusing forms, paying hefty fees, and waiting for their refund to hit the account.

It’s time-consuming and expensive. But that’s just how it works, right?

Wrong. That’s exactly what corporate tax prep giants hope you believe. Filing taxes could be much simpler—and free. Yet companies like TurboTax, H&R Block, and Jackson Hewitt have built a multi-billion-dollar industry by making the process seem more complicated than it is, all while profiting off the very people who can least afford it. A ProPublica article from five years ago exposed how tax prep companies have fought to keep tax filing complicated. It stated, “TurboTax rests on a shaky foundation, one that could collapse overnight if the U.S. government did what most wealthy countries did long ago—made tax filing simple and free for most citizens.”

TurboTax bombards hundreds of millions of people with ads featuring Black celebrities shuffling papers and receipts, reinforcing the idea that tax filing is overwhelming. Their solution? To help alleviate the confusion and uncertainty that they’ve created.

To be clear, business owners, high earners, and those with complex filings may need professional accountants. But the wealthy aren’t the people these companies target. Everyday people—especially Black taxpayers—are these company’s bread and butter. Also, who are the people preparing your taxes at these storefronts? An overwhelming majority are not accountants. They are company-trained company employees, and if they make a mistake, you answer to the IRS—not them.

This isn’t just a consumer issue; it’s a racial justice issue. Our report, Preying Preparers: How Storefront Tax Preparation Companies Target Low-Income Black and Brown Communities, exposes how crucial Black customers are to these companies’ business models: “Workers eligible for the earned income tax credit (EITC) continue to spend large sums—averaging around $400—at national tax preparation chains. In a recent survey of storefront operations in Baltimore and Washington, D.C., we found that low-income taxpayers can expect to spend between 13 and 22 percent of the average EITC refund to file their taxes.”

A Better Way

In many countries, tax filing is free and automatic—governments use existing records to send pre-filled returns. Simple. But in the U.S. the money is too good for that to be the case. The tax prep industry has spent decades lobbying against such reforms, companies like H&R Block and TurboTax have fought to turn filing into a costly burden that disproportionately harms low-income communities and people of color. In a membership survey conducted last year, one Color Of Change member said the following:

“When filing taxes, I always felt cheated or deceived by online services like Turbo Tax or storefronts like H&R Block.

Years ago, I filed my taxes with H&R Block (at the cost of about $400), only to be contacted to say my federal and state taxes had been filed incorrectly. As a result, my refund was much less than I was expecting. Because of this negative experience, I started using Turbo Tax only to be met with upsells and higher costs year after year.”

For Black families, high filing costs and predatory “refund loans” make tax season a financial strain—whether we acknowledge it or not. Preparation fees, which can range from $200 to $600, drain our resources that could go toward housing, food, or maybe just something nice for your family.

It doesn’t have to be this way. Right now, the IRS has launched Direct File in 25 states, offering a free, government-backed tax filing tool that cuts out the corporate middlemen. The government is using its power to make tax filing free and easy—but it’s not enough. Instead of allowing companies to exploit working families—especially Black households—we must demand a system that works for us, not against us. We must push for nationwide expansion of Direct File and hold companies like TurboTax accountable for the harm they’ve caused in our communities. Real reform means access to a safe and free option to file taxes. It means stronger protections against deceptive marketing and exploitative fees. And it means recognizing that tax policy is a racial justice issue.

Color Of Change has already saved our members over $220,000 by promoting Direct File in eligible states. Our members are keeping their money where it belongs: in their pockets. To corporations like H&R Block and TurboTax, $220,000 is a drop in the bucket—but for Black families, it’s a big deal.

The IRS has already proven that free, government-backed tax filing works. The only thing standing in the way? Corporate greed. It’s time to expand Direct File nationwide and stop allowing tax prep giants to profit off working families. Reach out to your state’s Department of Revenue and governor to urge them to implement Direct File.

Brandon Tucker is Sr. Director of Policy & Government affairs for Color Of Change an organization that leads campaigns that build real power for Black communities.

SEE ALSO:

The Grill Master: How George Foreman Leveraged His Boxing Career Into A Successful Business Empire

Altadena Businesses Reopen After The Wildfires, But Need Support

, Every year, tax prep giants rake in billions by charging fees for a service that should be free to every taxpayer.,  , Read More, App Feed, Business & Economy, National, Newsletter, News Archives – Black America Web, [#item_full_content].

, Read More, App Feed, Business & Economy, National, Newsletter, News Archives – Black America Web, [#item_full_content].

Written by: radiofresh106

Similar posts

Featured post

Latest posts

Could Trump Stay In Power Or Run For A 3rd Term?

Suspect in Sauce Walka Shooting Found Dead in Houston

Elon Musk Gave Out Million-Dollar Checks To Buy The Wisconsin Supreme Court

Terrifying Terrorizing Technology: Netflix Releases The Official ‘Black Mirror’ Season 7 Trailer Starring Issa Rae, Paul Giamatti, Tracee Ellis Ross & Many More

#Obama2028 Trends On X After President Donald Trump Floats 3rd Term Idea

Current show

Kenny J

For every Show page the timetable is auomatically generated from the schedule, and you can set automatic carousels of Podcasts, Articles and Charts by simply choosing a category. Curabitur id lacus felis. Sed justo mauris, auctor eget tellus nec, pellentesque varius mauris. Sed eu congue nulla, et tincidunt justo. Aliquam semper faucibus odio id varius. Suspendisse varius laoreet sodales.

closeUpcoming shows

Chart

Copyright 2024 Fresh 106 All Rights Reserved

Invalid license, for more info click here

Invalid license, for more info click here

Post comments (0)